Hi, I'm Matt Turner, the editor in chief of business at Insider. Welcome back to Insider Weekly, a roundup of some of our top stories.

On the agenda today:

- Airbnb hosts are panicking about a summer slowdown.

- Our profile of Danya Perry, the attorney defending billionaire Leon Black.

- Can Miami's pandemic-fueled tech boom survive an industry bust?

- Meet 2022's rising stars of EV, from companies like Rivian and Lucid.

By the way, we have a new newsletter coming soon: 10 Things on Wall Street will cover the biggest stories in banking, private equity, hedge funds, and fintech each weekday morning. Sign up here.

But first: Insider senior correspondent Linette Lopez is here with a look at the market's hectic week.

Subscribe to Insider for access to all our investigations and features. New to the newsletter? Sign up here. Download our app for news on the go – click here for iOS and here for Android.

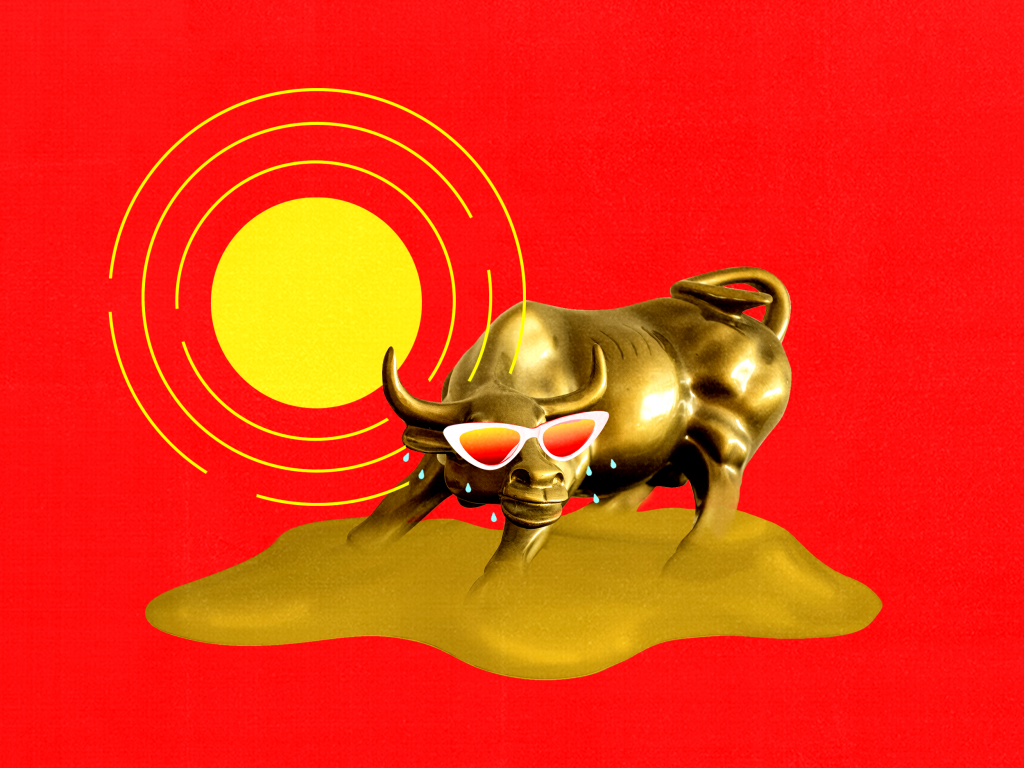

Wall Street's hellish summer is here

A week ago, I wrote that Wall Street is "heading into a summer from hell." Well, it looks like that hellish summer came early.

Since I wrote that piece, the market has done almost nothing but fall, posting the worst trading days since the early weeks of the pandemic. And while the sell-off is ugly, it's clear this isn't over.

The market is quickly retreating to where it was before the pandemic — and the stimulus-infused mega rally — started. And thanks to more than a decade of monumentally low interest rates, many investors think that even the current level is inflated.

In the piece, I called out the tech industry, which has been riding the wave of a strong economy for years and is finally facing its first real setbacks and (in some cases) layoffs.

"The kiss of death for tech is when tech starts talking profitability — then the tide goes out and you'll figure out who's been swimming naked," Justin Simon, a portfolio manager at Jasper Capital, told me.

But that's not all. Last week, bread-and-butter retailers Target and Walmart reported earnings that fell short of Wall Street's expectations. These consumer behemoths admitted that they are starting to feel the burn from inflation and other economic pressures.

As I said in my story, "This summer, the market is melting, and investors big and small are going to get burned before it's over."

Read Linette's full story here:

Airbnb hosts hit by summer slowdown

In May 2021, when domestic travel and the short-term-rental market were booming, travelers kept Airbnb properties in high demand. Today, it's a different story.

There is no shortage of theories about the slowdown. Some say overseas travel is siphoning traffic from domestic trips, while others believe that record-high gas prices have made guests less willing to hop in the car. One thing is certain: Vacation rentals are taking a big hit.

While watching their bookings drop, many hosts are getting thrifty to shelter themselves from the current market climate.

Read the full story here:

The former prosecutor defending Leon Black

Former prosecutor Danya Perry stood up to Andrew Cuomo and Eric Schneiderman. Now she's defending billionaire Leon Black against rape accusations.

Perry's defense of Black, the former CEO of Apollo Global Management, might seem incongruous with her past. But interviews with several dozen people who know her paint a picture of a woman who has operated in Black's circles for a long time — and repeatedly made controversial choices based on what she believes is right.

Read the full story here:

Is Miami still the next Silicon Valley?

During the pandemic, the tech industry fanned out across the US — and the geographically liberated workforce ended up in new places like beachy Miami.

But now, the US tech sector is on tenterhooks. Markets are crumbling, startup valuations are cratering, and tech firms are announcing layoffs daily.

The industry's uncertain future raises the question: Can Miami become the new Silicon Valley — or will it become a cautionary tale about placing all your bets on a bubble?

Read the full story here:

35 Under 35: The future of the EV industry

The electric-vehicle industry is a competitive space. The cars are critical, sure, but so are batteries, supply chains, fleet management, and charging infrastructures. These companies are complex operations that are dependent on razor-sharp talent to make it all run smoothly.

Insider has vetted the market and identified 35 people under the age of 35 who we believe are most likely to advance in the industry.

From cofounders and CEOs to engineers and scientists, the rising stars of the EV industry have a bright future ahead.

Read the full story here:

This week's quote:

"One million dollars may seem like a daunting number, but regardless of your wealth or income, it really is achievable if you have the right mindset. Map out a solid plan, adjust your budget as your income grows, and always prioritize savings."

- Tanya Taylor, founder of Grow Your Wealth, on how she saved $1 million for retirement by age 48.

More of this week's top reads:

- SpaceX paid a flight attendant $250,000 to settle a sexual-misconduct claim against Elon Musk in 2018, Insider found.

- Here are the top 15 cities where home-price appreciation has outpaced wages.

- Lady Gaga's Haus Labs makeup launch on Amazon bombed. Now it's set for a Sephora debut.

- Inside Amazon ProServe, an elite group in the company's cloud unit.

- These are the tech companies that are most at-risk as the market plunges.

- Are we in a housing bubble? We asked 32 experts.

- How a freelancer earned $1.6 million designing pitch decks for startups.

Plus: Keep updated with the latest business news throughout your weekdays by checking out The Refresh from Insider, a dynamic audio-news brief from the Insider newsroom. Listen here tomorrow.

Curated by Matt Turner. Edited by Lisa Ryan and Hallam Bullock. Sign up for more Insider newsletters here.